The tightening of tax administration and the issuance of a series of new policies from July 1, 2025 marks a major step forward in the modernization and transparency of Vietnam's tax system, strongly impacting individuals, business households and enterprises in all fields. Below is a detailed analysis of the main changes, outstanding new points, warnings and implementation instructions from GT Law Firm.

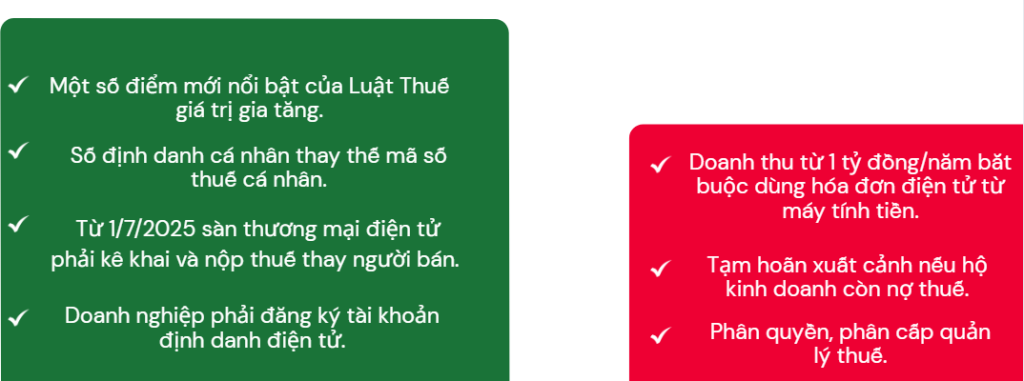

Law on Value Added Tax (VAT) Amended:

a. Adjustment of non-VAT taxable objects

- Some objects previously exempted from VAT such as fertilizers, agricultural machinery and equipment, offshore fishing vessels, securities depository services... are now subject to tax, significantly expanding the scope of tax liability.

- This forces businesses and related production and business households to review their supply chains, adjust their financial plans and tax declarations, to avoid being passive and surprised when the policy comes into effect.

b. Amending regulations on VAT calculation prices for imported goods

- VAT calculation prices for imported goods are adjusted according to market practices, tightening management to avoid price fraud and tax fraud in import and export activities.

- Import-export enterprises need to pay attention to updating to accurately determine tax obligations and prepare valid supporting documents.

c. Change tax rates on some goods and services

- Some groups of goods and services will apply new tax rates, increasing or decreasing compared to before depending on the state's regulatory direction.

- It is recommended that directly affected units review their product and service systems to determine appropriate new tax liability levels.

d. Changes in input tax deduction conditions

- For goods and services purchased under VND 20 million, it is mandatory to have non-cash payment documents to deduct input VAT; at the same time, additional cases/valid documents are added to expand the deduction, providing flexibility but tighter control over legality.

- Individuals and businesses need to develop transparent payment habits and fully store documents to ensure maximum legal tax benefits.

e. Raising the taxable revenue threshold for business households and individuals

- Business households and individuals with revenue below the threshold are exempted from declaration, tax exemption or have lower tax rates applied, more transparently for small businesses.

- Larger businesses will also have to strictly comply with the procedures for documents, invoices, revenue transparency, and mandatory electronic invoices in the near future.

Tax Administration Reform: Personal Identification Number Replaces Tax Code

a. Mandatory conversion to personal identification number

- The entire tax management process for individuals, business households, legal representatives... will switch from tax codes to using Personal Identification Numbers (SDDCN) from July 1, 2025.

- This regulation creates synchronization between tax data and the national population database, helping the tax sector manage more consistently and transparently, while minimizing administrative procedures for taxpayers.

- Taxpayers who have not yet converted can register to provide additional information or seek support at the tax authority.

b. Applicable objects

- All individuals who are required to declare and pay taxes or representatives of business households and enterprises are required to use personal identification numbers instead of tax codes in tax transactions and registrations.

c. Impact on declaration and management process

- Tax transactions, declarations, and settlements after July 1, 2025 must use SDDCN; cases that are not synchronized/correctly matched must immediately supplement information to avoid problems.

Tightening E-Commerce Tax Management: Trading Platforms Declare and Pay Taxes on Seller's Behalf

a. Responsibility for declaring and paying taxes on behalf of

- From July 1, 2025, domestic and foreign e-commerce platforms, including owners or authorized entities, must deduct and pay taxes on behalf of sellers who are business households and individuals doing business on the platform.

- Online sellers need to cooperate and provide full personal information, identification, business line, invoice status, etc. so that the e-commerce platform can deduct and pay taxes properly.

b. Objectives and significance

- Increase cash flow transparency, prevent state budget loss from online business.

- Ensure tax equality between traditional and e-commerce models.

Enterprises are required to register for electronic identification accounts.

a. Mandatory requirements

- Before July 1, 2025, businesses must complete the registration of electronic identification accounts (via the VNeID application or the National Public Service Portal), used in all transactions with state agencies, taxes, finance, administrative registration, etc.

- If not implemented, businesses will not be able to complete electronic administrative procedures, access national online services or declare taxes using new methods.

b. Registration process

- Register directly or online with a digital signature account, authenticate legal entities through the national identification system; check and supplement documents when requested.

- Information must be synchronized with the National Enterprise Database, ensuring authenticity and correct matching.

Upgrade Electronic Invoice: Mandatory Use With Revenue From 1 Billion VND/Year

- From June 1, 2025, households and individuals doing business with revenue of 1 billion VND/year or more in the retail, restaurant, hotel, transportation, etc. industries must use electronic invoices issued directly from cash registers with data connection to tax authorities.

- This regulation helps management agencies better control cash flow and actual revenue generated – thereby preventing tax losses and fraud.

Tightening Tax Enforcement Regulations, Temporarily Departing the Country When Tax Debts Remain

a. Subjects temporarily suspended from exiting the country

- Business individuals, business household owners or legal representatives of enterprises, cooperatives... who are forced to execute administrative decisions on taxes if they have tax debts of over 50 million VND (households, individuals) or over 500 million VND (enterprises, cooperatives) and are overdue for more than 120 days will have their exit temporarily suspended until they fulfill their tax obligations.

- In addition, cases that are no longer operating at the registered address or have a decision to enforce will also be subject to this enforcement measure.

b. Measures for coordination of implementation

- Tax authorities coordinate with border police and immigration control departments to update the list and prevent exit at airports and border gates of subjects who seriously violate tax obligations.

Promoting Decentralization and Tax Management Decentralization

- Local tax authorities are given more autonomy in reviewing, inspecting, identifying taxable entities, and handling administrative and criminal violations related to tax obligations.

- This helps speed up processing, reduce backlog of complex cases and maximize the proactive role of on-site management units.

Sanctions for Violations of Tax Obligations

- Acts of late payment, false declaration, tax evasion, etc. are all considered and handled according to the following levels: warning, fine, imprisonment, forced payment of full tax to the budget, temporary suspension of exit, ban on doing business in certain fields, temporary/permanent suspension of operations for commercial legal entities.

- The detailed penalty level will increase gradually according to the amount of violation and the nature of the violation, with serious cases also subject to criminal prosecution.

Contact GT Law Firm for Tax Legal Support

With these complex changes, understanding and applying them correctly can be challenging. GT Law Firm We are proud to be a trusted legal partner, providing in-depth tax, accounting and business consulting services. We will help you:

- Understand and apply the latest tax regulations.

- Review, evaluate and optimize tax obligations.

- Represent to resolve issues arising with tax authorities.

- Ensure full compliance with legal requirements, minimizing risks.

Contact us today to receive professional advice and solid support in complying with tax laws!